Minimum Acreage For Farm Tax In Kentucky . The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. • krs 139.481 requires that farmers who are eligible for. why is the agriculture exemption number needed? agricultural & horticultural exemptions & application. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. Taxpayers must notify the pva. the state provides a property tax break to farmers whose land use falls under either provision. the state provides a property tax break to farmers whose land use falls under either provision.

from www.kftc.org

you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. • krs 139.481 requires that farmers who are eligible for. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. Taxpayers must notify the pva. the state provides a property tax break to farmers whose land use falls under either provision. The purpose of the agricultural value program is to stimulate. agricultural & horticultural exemptions & application. Taxpayers must notify the pva. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. the state provides a property tax break to farmers whose land use falls under either provision.

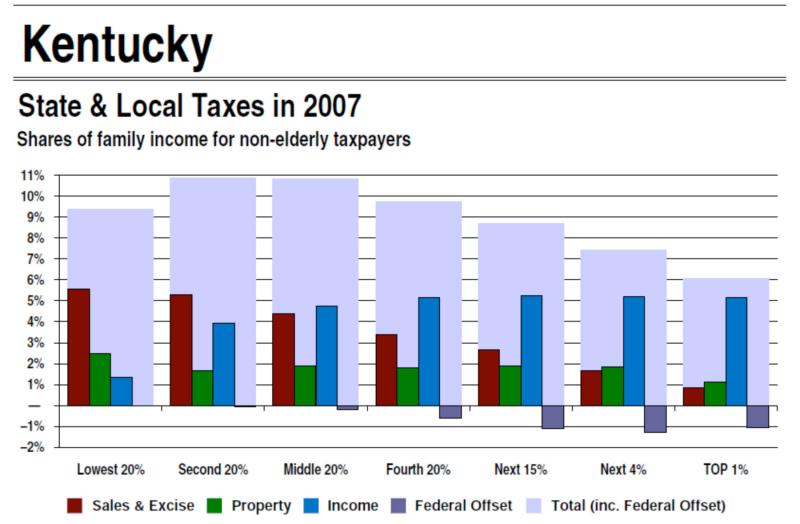

Kentucky's Tax Structure Is Not Fair Kentuckians For The Commonwealth

Minimum Acreage For Farm Tax In Kentucky legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. Taxpayers must notify the pva. • krs 139.481 requires that farmers who are eligible for. the state provides a property tax break to farmers whose land use falls under either provision. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. Taxpayers must notify the pva. the state provides a property tax break to farmers whose land use falls under either provision. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. why is the agriculture exemption number needed? The purpose of the agricultural value program is to stimulate. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. agricultural & horticultural exemptions & application.

From estabneilla.pages.dev

Kentucky Farm Tax Exempt Form 2025 Lola Lillian Minimum Acreage For Farm Tax In Kentucky you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. the state provides a property tax break to farmers whose land use falls under either provision. agricultural & horticultural exemptions & application. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales. Minimum Acreage For Farm Tax In Kentucky.

From estabneilla.pages.dev

Kentucky Farm Tax Exempt Form 2025 Lola Lillian Minimum Acreage For Farm Tax In Kentucky the state provides a property tax break to farmers whose land use falls under either provision. the state provides a property tax break to farmers whose land use falls under either provision. The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. you will need to have the agricultural sales tax exemption. Minimum Acreage For Farm Tax In Kentucky.

From bluegrassteam.com

Kentucky Farm Land bluegrassteam Minimum Acreage For Farm Tax In Kentucky you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. agricultural & horticultural exemptions & application. The purpose of the agricultural value program is to stimulate. • krs 139.481 requires that farmers who are eligible for. Taxpayers must notify the pva. Taxpayers must notify the pva. to receive the preferential. Minimum Acreage For Farm Tax In Kentucky.

From www.relakhs.com

Agricultural Taxation Rules FY 202324 A Complete Guide Minimum Acreage For Farm Tax In Kentucky agricultural & horticultural exemptions & application. why is the agriculture exemption number needed? the state provides a property tax break to farmers whose land use falls under either provision. Taxpayers must notify the pva. Taxpayers must notify the pva. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form.. Minimum Acreage For Farm Tax In Kentucky.

From www.taxuni.com

Kentucky Tax Calculator 2024 2025 Minimum Acreage For Farm Tax In Kentucky • krs 139.481 requires that farmers who are eligible for. The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. Taxpayers must notify the pva. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. the state provides a property tax. Minimum Acreage For Farm Tax In Kentucky.

From www.uslegalforms.com

Kentucky Farm Tax Exempt Requirements 2020 Fill and Sign Printable Minimum Acreage For Farm Tax In Kentucky the state provides a property tax break to farmers whose land use falls under either provision. • krs 139.481 requires that farmers who are eligible for. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. Taxpayers must notify the pva. legislation is now in effect that requires all farmers. Minimum Acreage For Farm Tax In Kentucky.

From www.teachoo.com

Different types of Agricultural Definition as per Tax Minimum Acreage For Farm Tax In Kentucky legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. why is the agriculture exemption number needed? The purpose of the agricultural value program is to stimulate. the state provides a property tax break to farmers whose land use falls under either provision. the. Minimum Acreage For Farm Tax In Kentucky.

From www.templateroller.com

Form 51A159 Fill Out, Sign Online and Download Printable PDF Minimum Acreage For Farm Tax In Kentucky Taxpayers must notify the pva. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. agricultural & horticultural exemptions & application. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. • krs 139.481 requires that farmers who. Minimum Acreage For Farm Tax In Kentucky.

From ebizfiling.com

What is Capital gain Tax on Agricultural Land? Minimum Acreage For Farm Tax In Kentucky agricultural & horticultural exemptions & application. • krs 139.481 requires that farmers who are eligible for. the state provides a property tax break to farmers whose land use falls under either provision. The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. to receive the preferential agricultural assessment, a tract of land. Minimum Acreage For Farm Tax In Kentucky.

From www.farmflip.com

Acreage, Farm, Hart County, Farm for Sale in Kentucky, 170548 FARMFLIP Minimum Acreage For Farm Tax In Kentucky to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. Taxpayers must notify the pva. agricultural & horticultural exemptions & application. why is the agriculture exemption number needed? The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. • krs 139.481 requires that farmers who. Minimum Acreage For Farm Tax In Kentucky.

From www.kftc.org

Kentucky's Tax Structure Is Not Fair Kentuckians For The Commonwealth Minimum Acreage For Farm Tax In Kentucky Taxpayers must notify the pva. Taxpayers must notify the pva. the state provides a property tax break to farmers whose land use falls under either provision. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. agricultural & horticultural exemptions & application. you will need to have the agricultural. Minimum Acreage For Farm Tax In Kentucky.

From www.ksba.org

Tax Rates Minimum Acreage For Farm Tax In Kentucky to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. the state provides a property tax break to farmers whose land use falls under either provision. why is the agriculture exemption number needed? you will need to have the agricultural sales tax exemption number and the farm exemption certificate,. Minimum Acreage For Farm Tax In Kentucky.

From www.zrivo.com

Kentucky Tax Filing Requirements Minimum Acreage For Farm Tax In Kentucky the state provides a property tax break to farmers whose land use falls under either provision. Taxpayers must notify the pva. to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. legislation. Minimum Acreage For Farm Tax In Kentucky.

From www.theoriginalcandleman.com

Kentucky Farms Sale. Farm land, acreage for sale. Kentucky waterfront Minimum Acreage For Farm Tax In Kentucky you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. why is the agriculture exemption number needed? Taxpayers must notify the pva. legislation is now in effect that requires all farmers eligible to make certain purchases exempt from sales and use tax to apply. to receive the preferential agricultural. Minimum Acreage For Farm Tax In Kentucky.

From itep.org

Tax Cuts 2.0 Kentucky ITEP Minimum Acreage For Farm Tax In Kentucky you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. agricultural & horticultural exemptions & application. Taxpayers must notify the pva. The purpose of the agricultural value program is to stimulate. Taxpayers must notify the pva. why is the agriculture exemption number needed? the state provides a property tax. Minimum Acreage For Farm Tax In Kentucky.

From www.teachkyag.org

Kentucky Agriculture and Forest Map — TeachKyAg Minimum Acreage For Farm Tax In Kentucky the state provides a property tax break to farmers whose land use falls under either provision. The purpose of the agricultural value program is to stimulate. agricultural & horticultural exemptions & application. why is the agriculture exemption number needed? you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form.. Minimum Acreage For Farm Tax In Kentucky.

From www.zrivo.com

Kentucky Nonresident Withholding Tax 2023 2024 Minimum Acreage For Farm Tax In Kentucky you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. The purpose of the agricultural value program is to stimulate. why is the agriculture exemption number needed? Taxpayers must notify the pva. Taxpayers must notify the pva. • krs 139.481 requires that farmers who are eligible for. to receive the. Minimum Acreage For Farm Tax In Kentucky.

From www.nass.usda.gov

USDA National Agricultural Statistics Service Charts and Maps All Minimum Acreage For Farm Tax In Kentucky to receive the preferential agricultural assessment, a tract of land must meet a minimum acreage requirement and. The purpose of the agricultural value program is to stimulate. • krs 139.481 requires that farmers who are eligible for. you will need to have the agricultural sales tax exemption number and the farm exemption certificate, form. legislation is now. Minimum Acreage For Farm Tax In Kentucky.